Tradeweb Exchange-Traded Funds Update – December 2022

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 47.8 billion in December, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was 80%.

Adam Gould, head of equities at Tradeweb, said: “2022 was another record year for ETF trading on Tradeweb. Nearly EUR 660 billion in total notional volume was executed on our European-listed ETF platform, up EUR 132 billion from 2021. There are several drivers behind this growth, including the secular trend in ETF product development, the strong liquidity of ETFs, and the huge flexibility they offer. We must not forget, however, that growth in this market is also being driven by the continued refinement of electronic trading workflows.”

Volume breakdown

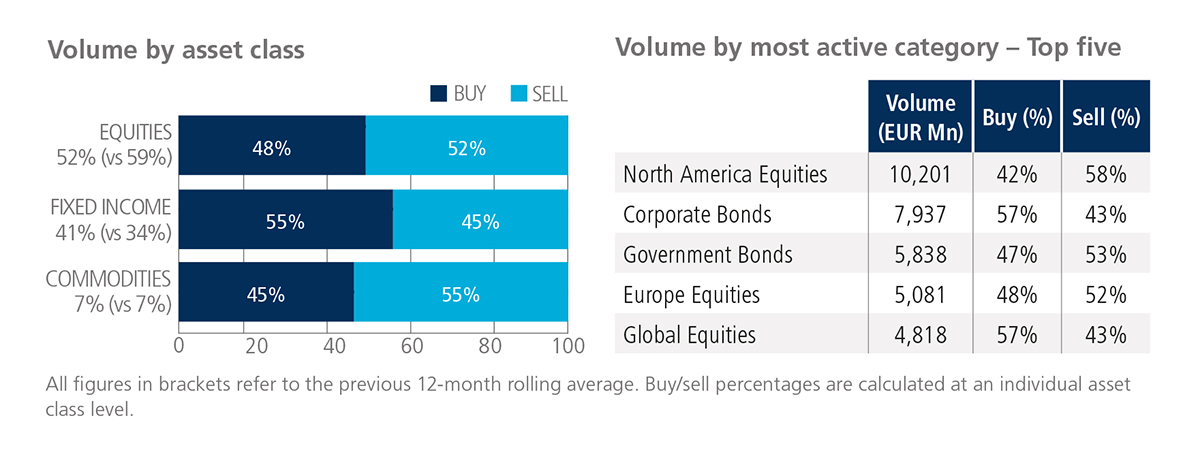

Equity and commodity-based ETFs saw net selling in December, with ‘sells’ surpassing ‘buys’ by four and 10 percentage points, respectively. In contrast, bond-based ETFs were mostly bought and saw their overall activity increase to 41% of the total platform flow, beating the previous 12-month rolling average by seven percentage points.

With over EUR 10.2 billion in total traded volume, North America Equities was the month’s most heavily-traded ETF category, followed by Corporate and Government Bonds.

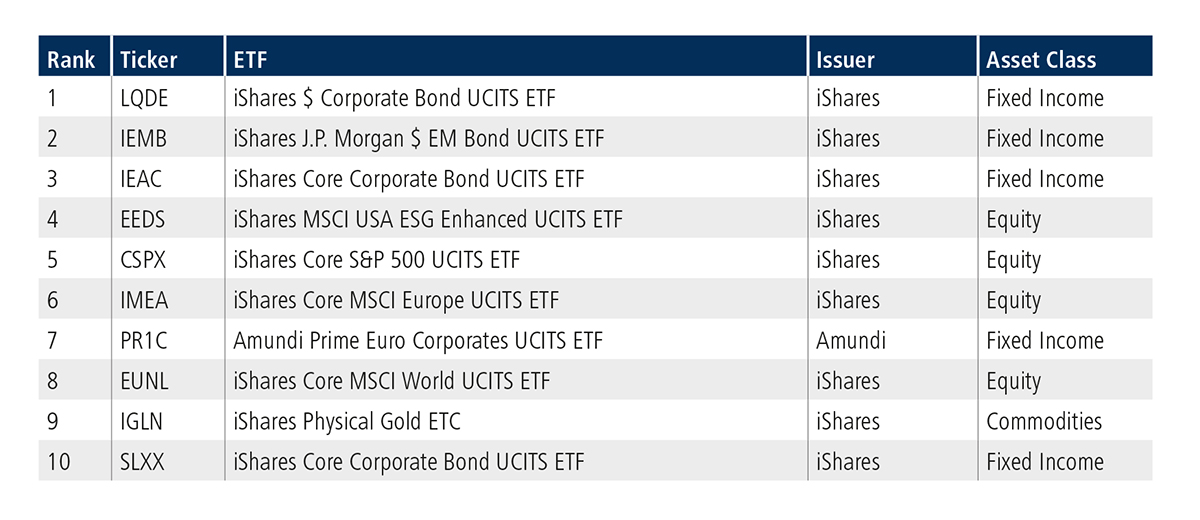

Top ten by traded notional volume

December’s top ten list by traded notional volume comprised four products offering investment exposure to corporate debt, with the iShares $ Corporate Bond UCITS ETF ranked first. The fund last occupied the top spot in October 2022.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in December 2022 amounted to USD 54.7 billion. Overall trading activity for the year was nearly USD 630 billion, a 106% increase from 2021.

Volume breakdown

As a percentage of total notional value, equities accounted for 50% and fixed income for 41%, with the remainder comprising commodity and specialty ETFs.

Adam Gould, head of equities at Tradeweb, said: “Despite the bond market having one of its most challenging years in recent history, we continued to see strong fixed income ETF volumes on our platform throughout 2022. In the U.S., fixed income ETF volumes accounted for 44% of notional traded, compared to 37% the year before. Fixed income ETF total volumes also made up 69% of those trades over USD 100 million.”

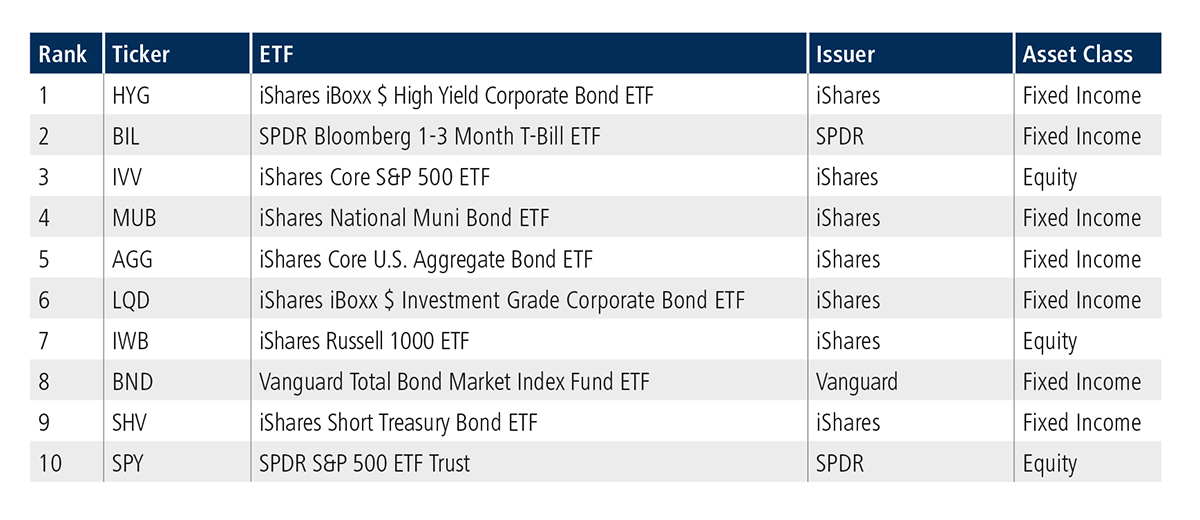

Top ten by traded notional volume

There were seven fixed income products among December’s ten most actively-traded ETFs, with the iShares iBoxx $ High Yield Corporate Bond ETF moving up two places from November to claim the top spot.

Related Content