The Bright Side of Muni Market Volatility: Tax-Loss Harvesting

The uncertainty around the timing of interest rate hikes these past two years has created an opportunity that municipal bond investors haven’t seen in a decade – gaining by losing. What we mean is tax-loss harvesting, a strategy rarely available to this market given munis’ historic stability and, more recently, the extended bull market run in bonds that preceded this latest Fed tightening cycle.

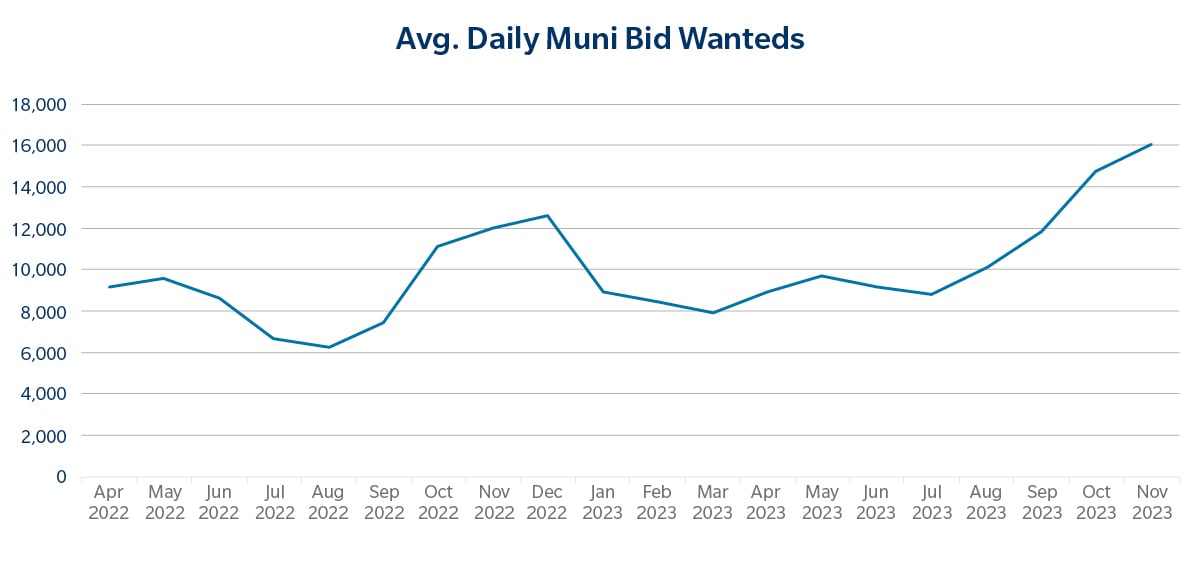

Now, with less than a month left before year’s end, we’re seeing strong evidence that institutional and retail investors are taking advantage of recent yield volatility to book these advantageous losses. The volume of bid wanted lists on the Tradeweb platform spiked in November and continues to run 70% higher than August year-to-date activity, prior to the temporary blip in municipal bond performance.

Through the first eight months of 2023, total returns in the muni market were positive, so tax-harvesting as a widely available strategy stayed on the shelf. However, with the market losing more than 3% in October and turning negative for 2023, investors could again consider the strategy to manage tax liabilities while dumping underperforming bonds. Investors had a similar opportunity to pursue tax-loss harvesting at the end of 2022, set up by a comparable spike in yields last September.

A surge in activity

For those who haven’t been around munis long enough to experience past downturns, tax harvesting might be an unfamiliar concept. The idea is simple tax management - investors sell securities with unrealized capital losses to offset realized capital gains. Those losses that exceed the gains in a given year can be carried forward to offset gains in future tax years.

Since September, we have seen institutions and retail investors alike pursuing the strategy in earnest. Evidencing this trend, users of Tradeweb Direct’s Portfolio Solutions analytics suite conducted holdings searches to identify municipal positions with unrealized losses in the month of September at a clip 82% higher than in the preceding eight months. What’s more, muni bid wanteds routed through Tradeweb Direct have also spiked, with October sell inquiries 65% greater than the August year-to-date average and November liquidation requests soaring 70% above that level.

Retail is on board

Given the dynamic role and high levels of participation of retail investors in the municipals market that’s not at all surprising. Retail investors are crucial to creating a high-functioning muni market and have themselves become more sophisticated, active market investors. They own roughly 60-70% of all municipal bonds outstanding, and are no longer just the buy-and-hold investor of last resort. Through advances in electronic trading, they’ve gained a direct conduit to the institutional sell side, and represent a big pool of market liquidity in both volatile and stable markets.

The tricky part of tax-loss selling for any investor comes when it’s time to reinvest. While buying similar securities - often to maintain portfolio allocations - is ok, IRS “wash rules” prohibit the purchase of substantially the identical investment within 30 days before or after the sale. Because liquidity in the muni market is largely driven by available inventory, finding a similar replacement manually for the asset that was sold can sometimes be a challenge. There are tools, though, that can help with the transaction and with locating a qualified replacement.

Leveraging the Portfolio Solutions analytics suite on Tradeweb Direct, investors can pursue tax-loss harvesting electronically, using features that support the end-to-end workflow of the strategy. Here’s how to get started:

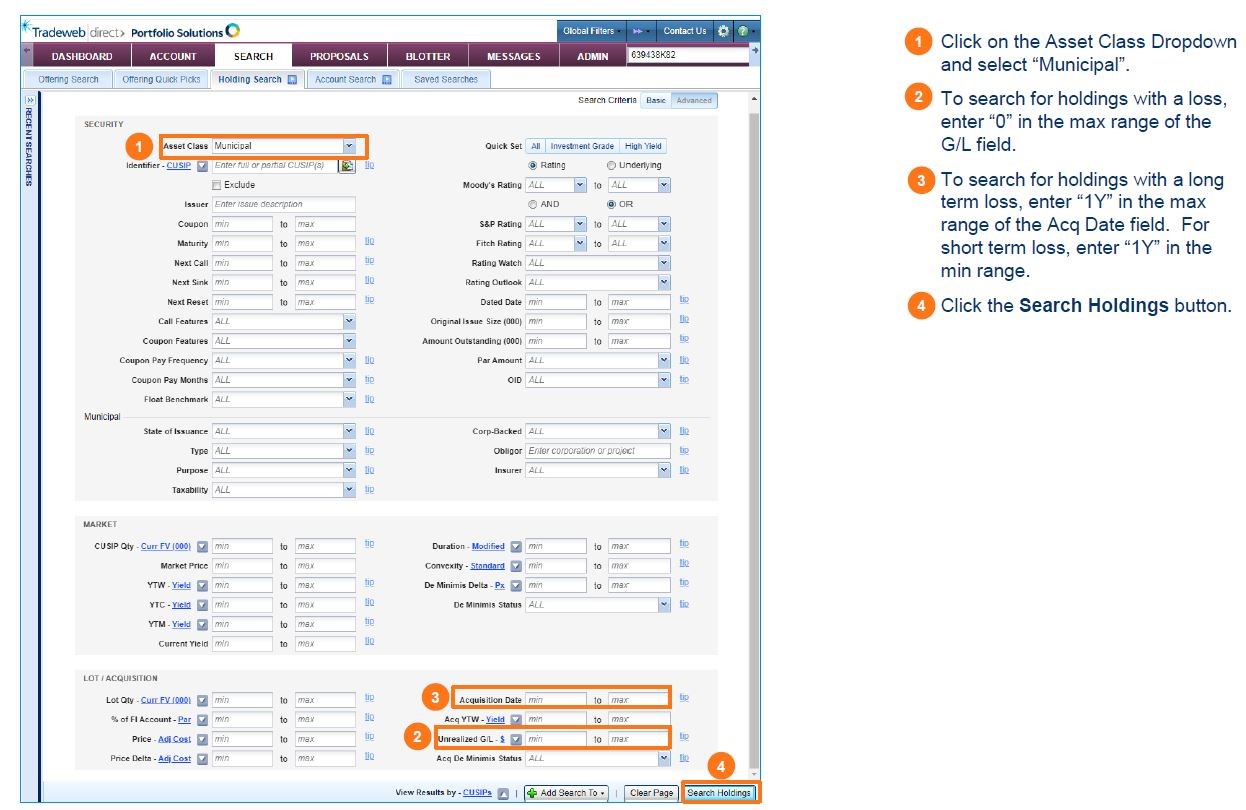

1. Identify your loss candidates

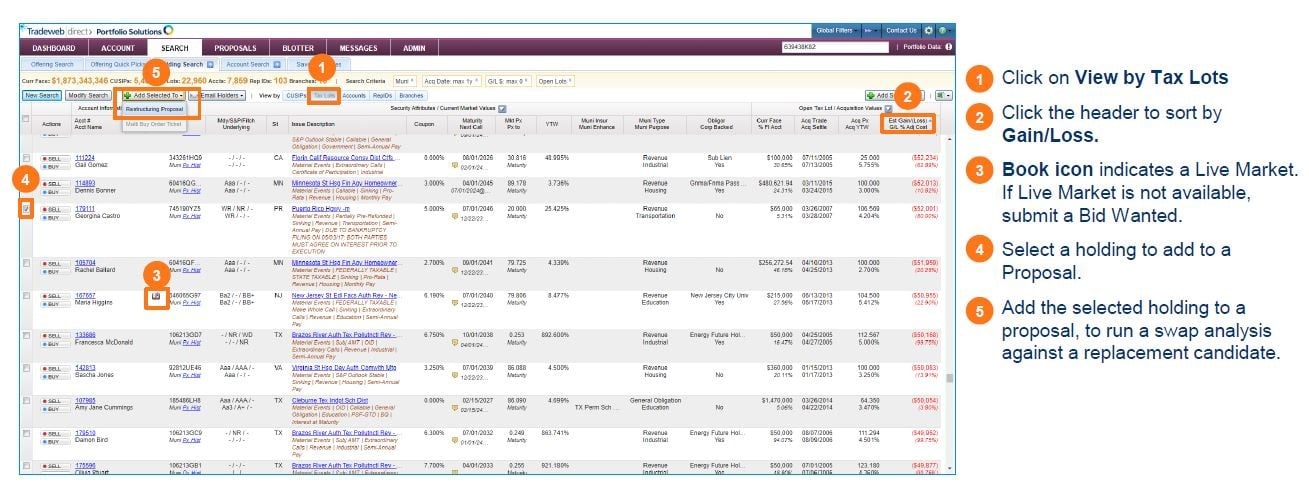

2. Add a swap candidate to a restructuring proposal

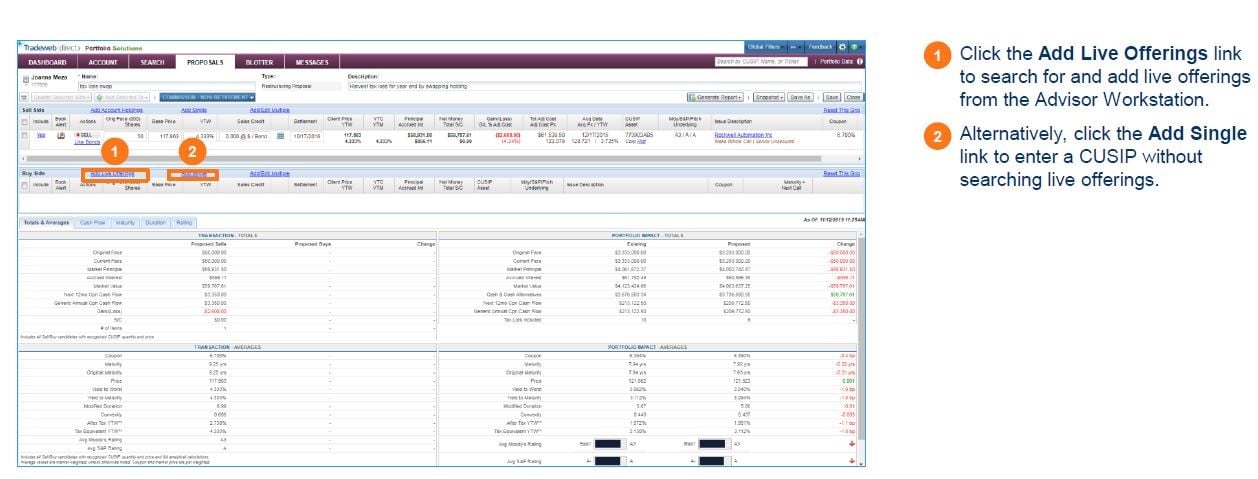

3. Add a replacement candidate to the proposal

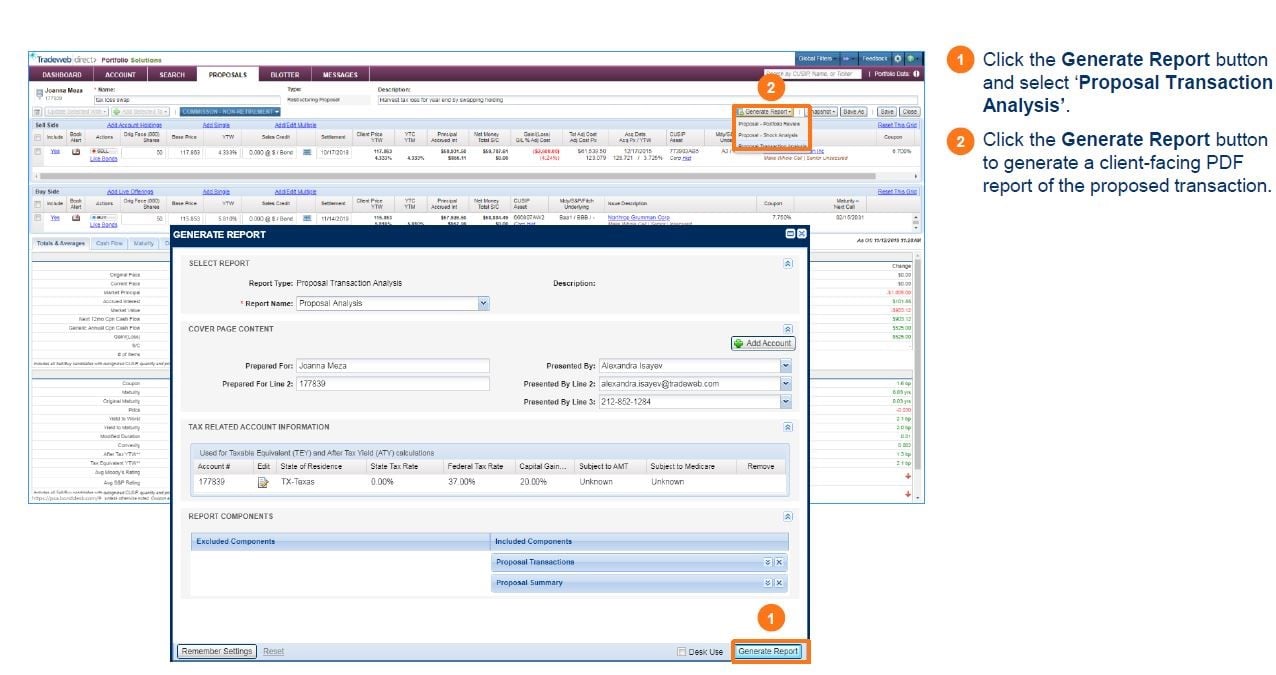

4. Generate a client-facing transaction report

As we’ve seen through periods of bond market volatility these past two years, sudden swings in yields present opportunities to use negative returns to your advantage. The windows open and close quickly, so being prepared, with the tools to enable fast execution, is essential. With year-end approaching and interest rates top of mind, it’s important to stay vigilant and move on tax-loss harvesting possibilities when they are available.

To learn more about Tradeweb Direct’s capabilities and how we can assist you in your trading strategies, click here.

© 2023 Tradeweb Markets LLC. The information contained herein is proprietary and may not be copied or redistributed without the prior written consent of Tradeweb Markets LLC. The content of this publication is for informational purposes only and is not offered as investment, tax or legal advice, or an offer to buy or sell securities. The information is provided “as is” and to the fullest extent permitted by applicable law, all warranties and representations are disclaimed.