Tradeweb U.S. ETF Trading Volume Surpasses $12 Billion Year-to-date

Electronic RFQ Trading Delivers Competitive Pricing and Access to Liquidity for Institutional Investors

NEW YORK, N.Y. (October 5, 2016) - Tradeweb Markets, a leading builder and operator of global fixed income, derivatives and ETF marketplaces, announced that more than $12 billion notional volume has traded year-to-date on its electronic request for quote (RFQ) platform for U.S. ETFs since launching in Q1 2016. Now with 18 market makers trading with more than 135 clients, the platform is demonstrating valuable access to institutional-sized liquidity with average trade size exceeding 135,000 shares in Q3.

"The remarkable growth on our platform continues to demonstrate how our streamlined workflow puts market makers in competition to achieve better pricing and access to ETF liquidity," said Lee Olesky, CEO of Tradeweb. "Market participants demand more flexible and effective solutions to trade ETFs in ways that suit the increasing sophistication of their investing strategies. Tradeweb is helping unlock those opportunities with RFQ trading."

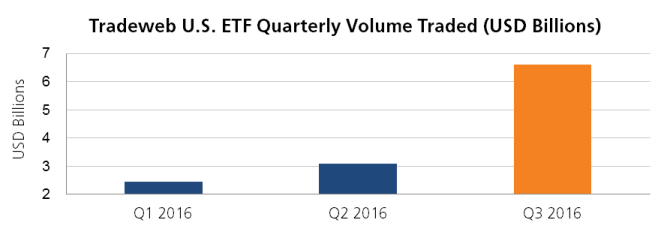

The growth of the Tradeweb U.S. ETF platform has accelerated dramatically during record investment into ETFs. Over the last quarter alone, trading volume more than doubled in Q3 v. Q2:

Tradeweb and its growing network of ETF clients have raised a new standard for execution of block and NAV trades, and for securities that appear relatively less liquid on exchange. From aggregated pre-trade transparency and National Best Bid and Offer (NBBO) pricing, to electronic audit trails for compliance and best execution reports, the platform supports the entire trade lifecycle with automated workflows.

"Tradeweb's introduction of an RFQ-style ETF market offers us transparent and competitive price discovery, with a streamlined workflow for trade processing," said Mark MacQueen, Co-Founder of Sage Advisory. "And as the ETF market continues to grow, gaining access to liquidity that offers size, quality pricing, and protection against information leakage is ever more valuable to us."

The Tradeweb U.S.-listed ETF platform complements its marketplace for European ETFs, which is the leader in D2C OTC electronic ETF trading in Europe. Since launching in 2012, more than €290 billion in notional ETF volume has traded on the European platform, and average daily trading volume now exceeds €500 million. Clients have successfully executed single block ETF trades in excess of €300 million on Tradeweb, with more than 90% of trades executed within the best bid-offer prices from exchanges in the first half of 2016.

About Tradeweb Markets

Tradeweb Markets builds and operates many of the world's most efficient financial marketplaces, providing market participants with greater transparency and efficiency in fixed income, derivatives and ETFs. Focused on applying technology to enhance efficiency throughout the trade lifecycle, Tradeweb pioneered straight-through-processing in fixed income and now supports marketplaces for more than 20 asset classes with electronic execution, processing, post-trade analysis and market data in an integrated workflow. Tradeweb Markets serves the dealer-to-customer markets through the Tradeweb institutional platform, inter-dealer trading through Dealerweb, and the U.S.-based retail fixed income community on Tradeweb Direct. Customers rely on Tradeweb to drive the evolution of fixed income and derivatives through flexible trading architecture and more efficient, transparent markets.