Casting a Wider Net

Tightened balance sheets and pressure to manage costs are driving change in the corporate bond market, and Tradeweb's new electronic tools are set to revolutionize credit trading with optimized workflows that improve efficiencies

Credit inventory has shifted significantly towards buy-side participants, highlighting new challenges for investors in accessing liquidity while delivering best execution. Focused on better ways to find the other side of their trade, the industry has seen the rise of all-to-all trading solutions to help broaden trading networks on electronic venues and grow electronic market share in US high-grade credit to more than 20 percent, for example. Market participants are beginning to approach corporate bond trading differently, however, and have begun leveraging technology to streamline their workflows for the bulk of their block institutional business. Relationships are being digitized with greater operational efficiency, and investors are benefitting from automated trade processing and risk netting to reap significant cost savings.

A Move to Seamless Spotting

Long advocates of flexibility in the ways investors can trade electronically; Tradeweb appears to have accelerated the adoption of electronic execution with automated price spotting for high-grade credit trades with direct connectivity to its US Treasury marketplace. Chris Bruner, head of US credit at Tradeweb, says firms leveraging this new technology can free up resources to focus on trade ideas and value-adding activities instead of trade processing. "When a credit trader buys a corporate bond on spread, for example, they need to spot that trade against the corresponding Treasury benchmark to finalize the price," says Bruner, a process that can take up to 15 minutes to confirm with a bank Treasury desk by phone. "Traders don't want to wait a long time to spot their trade with a Treasury desk, or risk manual errors in processing trades, when they have more orders to focus on," he says, explaining how traders can put down the phone and benefit from a complete audit trail in a streamlined spotting workflow. Liquidity providers also benefit from automated price spotting for credit trades, allowing them to immediately offset their interest rate risk of the credit liquidity they're providing with a corresponding Treasury trade, Bruner says. "Both buy- and sell-side parties reduced their execution risk by decreasing the time to quote, whereas historically, movements in the Treasury market while waiting to spot a trade could have a significant impact". Tradeweb has since become one of the fastest-growing credit platforms in the US, demonstrating that electronifying relationship-based trading can meaningfully enhance investors' operational efficiency and cost savings. However, with the introduction of new technology to net the spots for all high-grade corporate bond trades across a trading desk, Tradeweb may be on the cusp of drastically reducing operational risk for credit market participants.

Introducing Multi-Dealer Netting

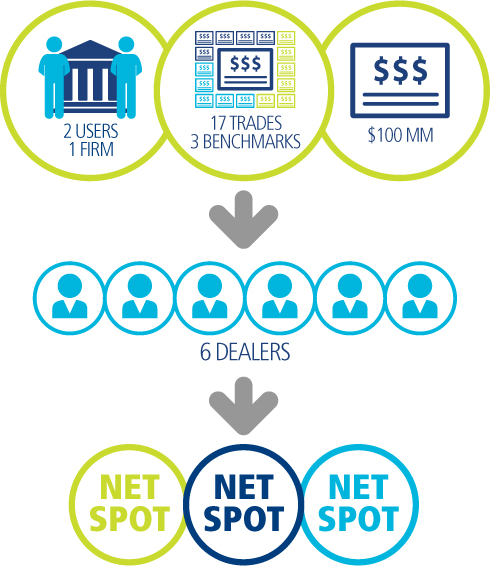

Multi-dealer netting adds another layer of efficiency to automated spotting, according to Bruner, allowing investors to condense the number of spots they need to request from a Treasury desk and the corresponding bid or offer paid on each of those trades. "Net spotting is one of the most exciting innovations in the high-grade market, it's something that didn't exist in the marketplace before," he says. The new functionality allows firms to collectively spot their combined voice and electronic trades, enabling traders to price and execute baskets of exposure in a list for larger parts or the entirety of their funds, calculate the net hedge, and offset the interest rate risk in as little as one trade. For example, Tradeweb completed the first multi-dealer net spot in September, where two users on one trading desk executed 17 different trades with six different dealers and three different Treasury benchmarks to spot against. By leveraging multi-dealer netting, the firm netted the risk for 14 of 17 trades, and was able to reduce their execution risk by spotting those trades immediately. "That's the equivalent of compressing 17 conversations into a few clicks, while delivering scalable savings in execution costs for all participants", says Bruner. "This is the next level of value innovative platforms like Tradeweb are bringing to the market, enhancing relationship-based trading with real operational efficiency for the trading desk".

There is a better way to trade, click here to learn more.