Tradeweb Announces Record Volume of $7.9 Trillion in November Since the Credit Crisis

NEW YORK, NY (December 2, 2016) - Tradeweb Markets, a leading global provider of fixed income, derivatives and ETF marketplaces, announced record volume of $7.9 trillion in November, the most active month of trading across its platforms since the credit crisis.

Tradeweb volumes and trade counts peaked in the two days following the election, but showed sustained activity across a wide range of asset classes, market participants, and on- and off-the-run securities over the following weeks. On the Tradeweb Institutional platform, the growth represents a 32% increase in November trading volume to $5.1 trillion year-over-year.

"Trading volumes have continued to increase on our platforms throughout November, beginning with volatility immediately around the election," said Lee Olesky, Tradeweb Markets CEO. "While bond markets have fallen significantly in recent weeks, we are seeing widespread increases in activity across all types of institutions, and in all ranges of maturities."

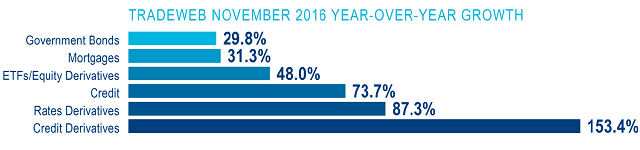

The Tradeweb institutional business saw significant year-over-year growth across macro asset classes, including:

Macro products comprised the majority of Tradeweb Institutional trading in November 2016, led by mortgage backed securities, government bonds, and interest rate derivatives. And products that saw 2016 volume highs in November across many of its 20+ asset classes include:

- U.S. Treasuries

- U.S. and European ETFs

- European Government Bonds

- European Repo

- U.S. Investment Grade and High Yield Credit

- Japanese Government Bonds

Olesky added, "This could be the beginning of a long-term change in market behavior, with the continued likelihood of rising interest rates, possible policy shifts from the Fed, and new expectations for inflation. If the broader asset management community is restructuring their portfolios over the next year, we may see growing trading volumes in light of increased volatility and shifts in fundamental investing strategies."

Tradeweb Markets also operates wholesale and retail marketplaces with Dealerweb and Tradeweb Direct, which saw significant increases in trading in November. Combined with institutional volumes, Tradeweb Markets Overall volume reached its highest level since the credit crisis with $7.9 trillion traded in November.

About Tradeweb Markets

Tradeweb Markets builds and operates many of the world's most efficient financial marketplaces, providing market participants with greater transparency and efficiency in fixed income and derivatives. Focused on applying technology to enhance efficiency throughout the trade lifecycle, Tradeweb pioneered straight-through-processing in fixed income and now supports marketplaces for more than 20 asset classes with electronic execution, processing, post-trade analysis and market data in an integrated workflow. Tradeweb Markets serves the dealer-to-customer markets through the Tradeweb institutional platform, inter-dealer trading through Dealerweb, and the US-based retail fixed income community on Tradeweb Direct. Customers rely on Tradeweb to drive the evolution of fixed income and derivatives through flexible trading architecture and more efficient, transparent markets. For more information, visit www.tradeweb.com .