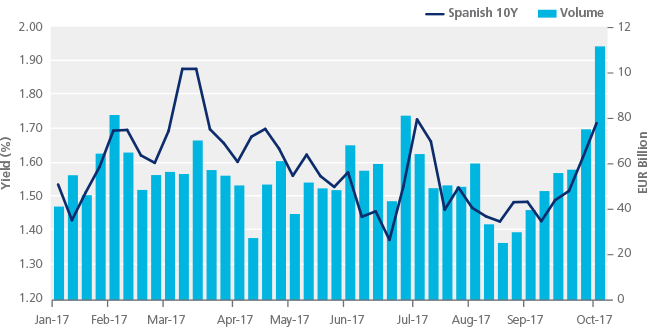

Record Spanish Bond Volumes amid Catalan Independence Vote

A record volume of the Spanish bonds[1] traded hands on the Tradeweb’s European Government Bond platform last week following the Catalan independence referendum vote. Executed volumes of the Iberian kingdom’s debt were more than double its average weekly volumes for 2017, while trade count was up almost 50%, and were over €3 billion greater than any other week on the platform.

Volumes were 14% higher than trading in French bonds, and nearly equalled the notional volume of German bund activity in the first week of October.

This is the first time since 2013 that Spanish bonds have been the second most actively traded sovereign by volume in the Eurozone on Tradeweb, which launched European government bond trading in 2000. The rise in activity was especially acute in the 10Y sector of the curve, where volumes were over 185% above average, as the benchmark was fairly volatile and finished the week over 10bp higher.

Year-to-Date Weekly Volumes of Spanish Government Bonds and 10Y Benchmark Bid-Yield

The Tradeweb European Government Bond marketplace is a leader in D2C OTC electronic trading of nominal bonds, inflation-linked bonds, treasury bills, strips and CCTs from more than 20 countries in Europe. Launched in 2000, the platform provides buy-side firms with access to liquidity from 36 of the world’s largest dealers in EUR, GBP, DKK, SEK, NOK, CHF and HUF issues. Clients also benefit from enhanced pre-trade information and analysis to meet ‘best execution’ requirements thanks to 2,000+ live axes posted directly by European government bond liquidity providers. Furthermore, Tradeweb’s automated trading tool enables buy-side traders to define parameters that determine how to execute different profiles of orders, thus enhancing trading efficiency and capacity to focus on larger size transactions.

[1] Nominal bonds, STRIPS and Inflation-Linked Bonds