Market Snapshot: U.S. 3-Month Yield Hovering Near Its Highest Point in 8 Years as Treasury Yields Fall Following Jobs Report

Yields on U.S. Treasuries fell following today’s jobs report, with securities with longer maturities falling the most.

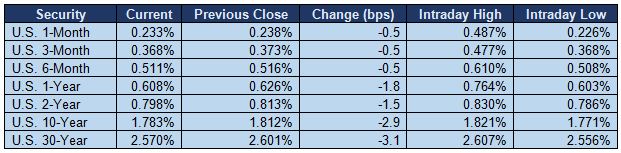

According to Tradeweb data, yields on the 2-year note declined by 1.5 bps, while yields on the 10-year note and 30-year bond each dropped by 2.9 bps and 3.1 bps, respectively.

Yields on 1- and 6-month bills both fell by 0.5 bps.

The yield on the 3-month bill also declined by 0.5 bps to 0.368% but is still hovering near its highest point in almost 8 years. Yesterday’s close of 0.373% was the highest since November 5, 2008, when it reached 0.416%.

Today’s jobs report showed a gain of 161,000 jobs for October, compared to a revised 191,000 for September and a revised 176,000 for August.

Included below are numbers based on indicative, real-time data from Tradeweb as of 2:10 PM ET.

Yields

CHART 1: U.S. 3-Month Yield – November 6, 2015 - November 4, 2016 (12-Month View)

CHART 2: U.S. 10-Year Yield – November 6, 2015 - November 4, 2016 (12-Month View)