Market Snapshot: U.S. 2yr, 10yr Yields Drop Following Chinese Volatility, ISM Data

Yields on U.S. Treasury notes dropped today, according to data from Tradeweb.

The bid yield on the 2-year U.S. Treasury note was 1.032% as of 2:20 PM EST, down 3.2 bps from Thursday’s close of 1.064%. Today’s intraday low was 1.008%, while the intraday high was 1.072%.

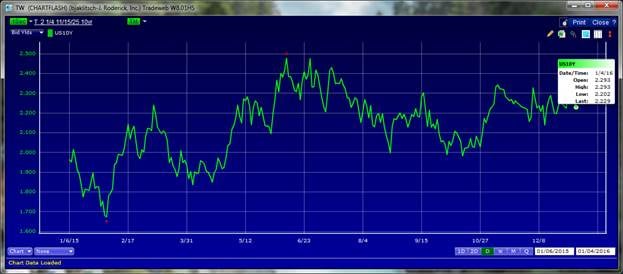

The bid yield on the 10-year U.S. Treasury note was 2.229% as of 2:20 PM EST, down 4.6 bps from Thursday’s close of 2.275%. Today’s intraday low was 2.202%, while the intraday high was 2.293%.

These moves follow increased volatility in China’s equities markets and the release of ISM Manufacturing index data, which fell to 48.2% in December from 48.6% in November.

In Europe, the bid yield on the 10-year German Bund was 0.572%, down 6.1 bps from Thursday’s close of 0.633%. Today’s intraday low was 0.559%, while the intraday high was 0.634%. This follows economic data from Germany’s statistics agency Destatis showing annual inflation slowing to 0.2% in December from 0.3% in November.

The charts below are based on indicative, real-time data from Tradeweb.

CHART 1: U.S. 2-Year Treasury Yields – January 6, 2015 – January 4, 2016 (12 Month View)

CHART 2: U.S 10-Year Treasury Yields – January 6, 2015 – January 4, 2016 (12 Month View)

CHART 3: German 10-Year Bund Yields – January 6, 2015 – January 4, 2016 (12 Month View)