Japan Government Bond Update - April 2015

Key Points:

- Real GDP estimate shows drop of 2.1% in February

- Fitch downgrades Japan’s credit rating to A from A+

- BoJ keeps monetary stimulus program unchanged

Monthly gross domestic product shrank 2.1% in February, the Japan Center for Economic Research said on April 2. A preliminary report released on April 8 by the Finance Ministry, however, showed that February’s current account surplus had topped 1 trillion yen for the first time in almost two years.

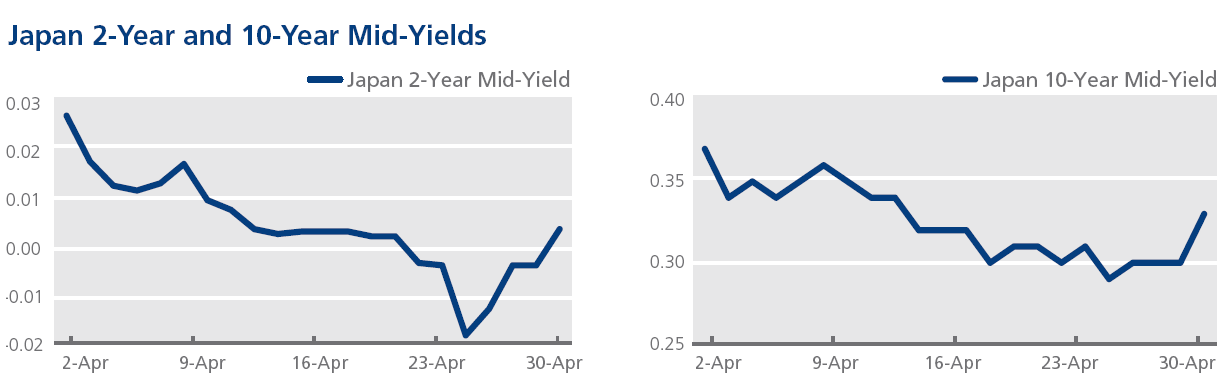

On April 22, Japan’s 2-year benchmark bond mid-yield closed below 0% for the first time since January 28. Five days later, Fitch Ratings downgraded the country’s credit rating by one notch to A, citing “the high and rising level of government debt”.

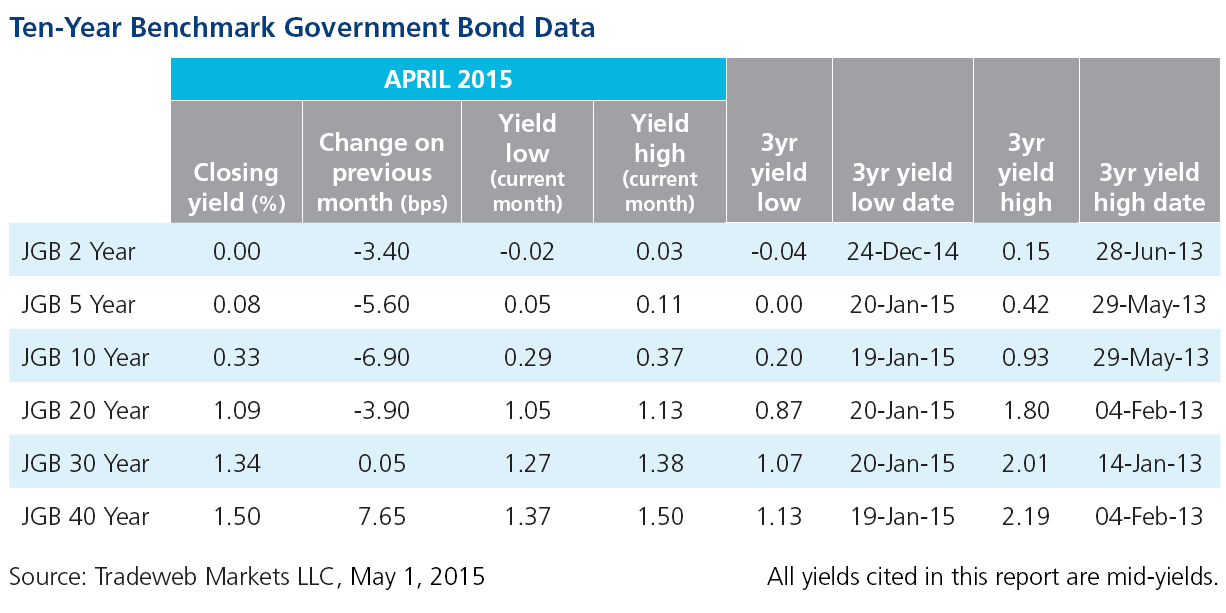

Meanwhile, the Bank of Japan maintained the pace of its monetary policy and trimmed its 2015 inflation and growth forecasts to 0.8% and 2% respectively. Speaking at a news conference on April 30, Governor Haruhiko Kuroda said that the central bank now expected to hit its 2% inflation target sometime between April-September 2016. Japan’s 10-year government bond mid-yield ended the day at 0.33%, almost three basis points higher from the previous market close.