European Exchange-Traded Funds Update - November 2016

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

November proved to be the strongest month for the Tradeweb European-listed ETF marketplace since its launch four years ago. Total traded volume exceeded €15.1 billion, beating July’s previous record by more than €2.5 billion. Adriano Pace, managing director for equity derivatives at Tradeweb, said, “Platform activity began to significantly increase around the U.S. general election, and continued to reach new heights following Donald Trump’s surprise victory. Corporate and Inflation-Linked Bonds were the only two ETF categories experiencing a drop in volumes compared to October, as the Trump administration seems to favour fiscal policies focused on higher inflation and faster interest rate hikes.”

Volume by ETF asset class

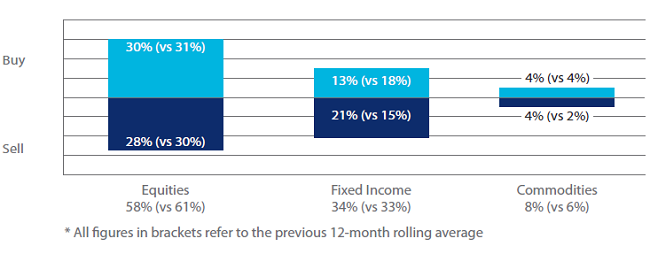

Activity in equity-based ETFs amounted to 58% of the overall platform flow, three percentage points lower than the previous 12-month rolling average. North America Equities was by far the most heavily-traded sector with nearly €2.5 billion in notional, of which 59% was ‘buys’. Emerging Markets Equities came second with traded volume amounting to just below €1.8 billion. Similarly to its fixed income counterpart, the sector saw net selling during the month amid concerns over the impact of future U.S. policies on trade and immigration.

Overall, there was a clear selling bias in fixed income ETFs, as ‘sells’ in the asset class outstripped ‘buys’ by eight percentage points. Government Bonds were once again the most popular fixed income category with more than €1.6 billion in traded notional. Meanwhile, activity in commodity-based ETFs outperformed the previous 12-month rolling average by two percentage points.

Top ten ETFs by traded volume

There were five fixed income products among November’s most actively traded ETFs, including two instruments offering exposure to Emerging Markets. However, the top spot was held by db x-trackers MSCI USA Index UCITS ETF, a fund that has featured in the top ten list five times this year.