Exchange-Traded Funds Update - August 2016

The following data is derived from trading activity on the Tradeweb European-listed ETF platform.

ETF total traded volume

August proved to be a quiet month for the Tradeweb European-listed ETF marketplace, which saw a 37% reduction in volumes compared to our July previous record. The slowdown in activity, driven partially by less volatile markets coupled with the traditional summer lull, resulted in the ETF platform’s quietest month so far this year. “In August we saw a similar number of clients trading as in previous months, however their average trade sizes were significantly reduced” said Adriano Pace, managing director for equity derivatives at Tradeweb.

On a positive note the platform’s trade hit rates held up very well at 91% over the course of the month, indicating that clients were able to efficiently execute despite the quieter environment.

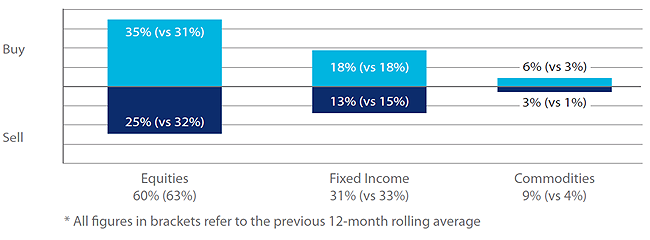

Volume by ETF asset class

Similar to what we saw in July, there was a clear buying trend across all ETF asset classes during the month of August. “Buys” for fixed income ETFs surpassed “sells” by five percentage points and “buys” in equity products outstripped “sells” by 10 percentage points.

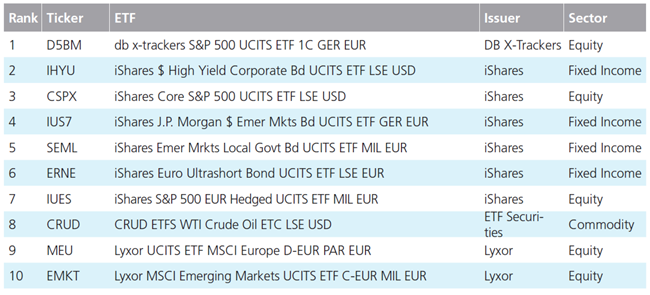

Top ten ETFs by traded volume

There were four funds offering exposure to fixed income assets among August’s top ten ETFs by traded volume. In second place, the iShares $ High Yield Corporate Bond UCITS ETF, featured in the top ten for the third time this year.