European Credit Update - May 2016

The possibility of a further interest rate hike in the U.S. and Britain’s potential exit from the European Union dominated headlines in May. Meanwhile, the euro area remained in deflationary territory for the fourth consecutive month, after consumer prices fell 0.1% year on year.

May saw the fourth highest euro-based corporate bond issuance on record, according to Dealogic. Data from Thomson Reuters also showed that issuance in the sector had reached more than EUR 110 billion since the European Central Bank’s announcement in March that it would add corporate bonds to its asset purchase programme.

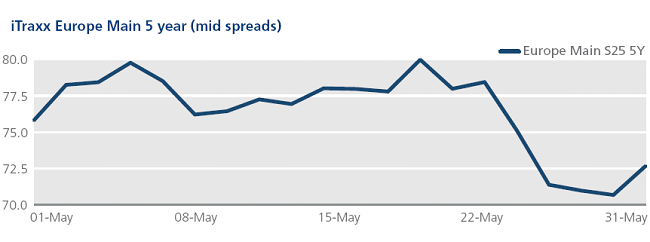

CDS on Tradeweb: Spreads for European credit indices moved wider until May 19, when the Europe and the Crossover closed at 80 bps and 337 bps respectively. However, both indices ended the month in tighter territory, closing at 73 bps and 310 bps respectively. Financial indices had a similar trajectory, with spreads for the FinSen and the FinSub closing at 90 bps and 195 bps respectively on May 31.

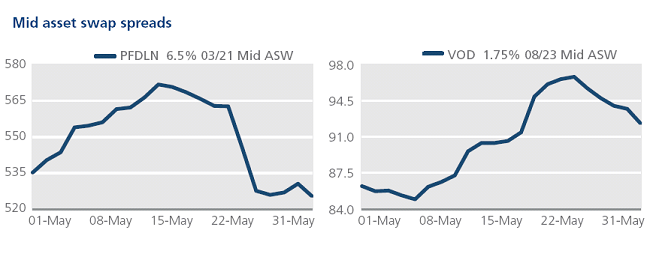

Cash on Tradeweb: UK’s Premier Foods reported a 0.6% increase in annual sales to GBP 772 million on May 17, approximately a month after U.S. spice giant McCormick walked away from a proposed GBP 537 million takeover. Mid asset swap spreads for the firm’s 6.5% 03/21 bond tightened by 10 bps between May 3 and May 31 to close at 525 bps.

In the telecommunications sector, Vodafone released its final results for the year ended March 31. CEO Vittorio Colao said that the mobile phone operator had returned to organic growth in both revenue and EBITDA for the first time since 2008. Mid asset swap spreads for Vodafone’s 1.75% 08/23 bond widened to 97 bps on May 24, but finished the month 5 bps tighter at 92 bps.

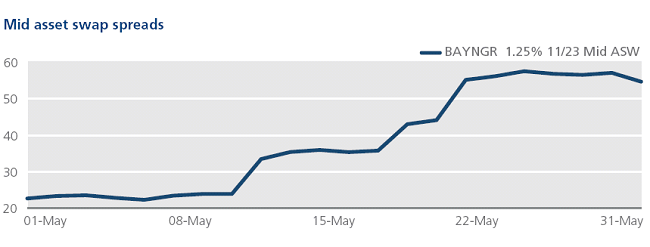

German drugs and chemicals group Bayer launched a USD 62 billion bid to acquire global agriculture group Monsanto. However, its offer was rejected as "incomplete and financially inadequate" on May 24. In the secondary market, mid asset swap spreads for Bayer’s 1.25% 11/23 bond widened by 32 bps to 55 bps over the month.