European Credit Update - June 2016

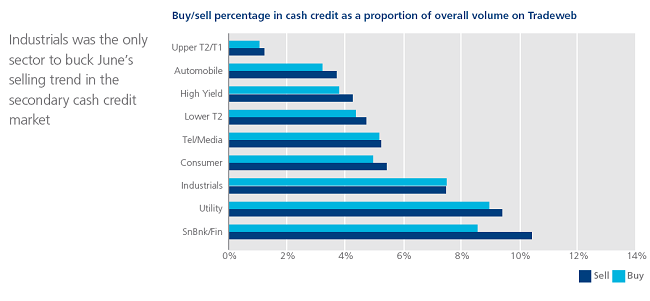

The European Central Bank (ECB) launched its corporate sector purchase programme (CSPP) on June 8, in a bid to boost inflation and stimulate economic growth in the Euro area. Purchases included non-financial investment-grade euro-denominated bonds with a maturity of six months to 30 years, and were conducted in both the primary and secondary markets via six national central banks. According to data published by the ECB, €6.4bn of securities were bought in the three weeks to June 30, mainly in the Utilities sector.

Meanwhile, Britain voted to leave the European Union (EU) in a referendum conducted on June 23, leading to the resignation of prime minister David Cameron. The pound tumbled to a 31-year low against the U.S. dollar, while ratings agencies Fitch and Standard & Poor’s downgraded the country’s credit rating from AA+ to AA and from AAA to AA respectively on June 27.

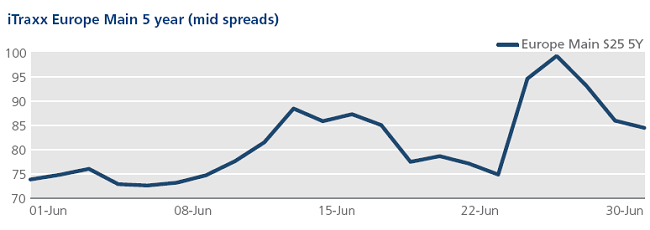

CDS on Tradeweb: June proved to be a volatile month for European credit indices. Spreads for the Europe and the Crossover closed at 95 bps and 398 bps respectively on June 24, moving 20 bps and 77 bps wider on the previous day’s close. Both indices closed as wide as 99 bps and 421 bps respectively on June 27, before retreating to 85 bps and 369 bps by month end.

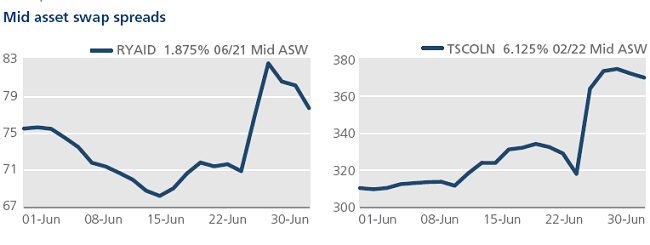

Cash on Tradeweb: International Airlines Group, the parent company of four airlines including British Airways and Iberia, warned that it no longer expected to generate “an absolute operating profit increase similar to 2015,” following the outcome of Britain’s EU referendum. The creation of the single aviation market in the 1990s allowed airline carriers – such as easyJet and Ryanair - to operate services on any route within the EU without commercial restrictions. Mid asset swap spreads for Ryanair’s 1.875% 06/21 bond widened by 12 bps between June 23 and June 27 to close at 83 bps.

According to figures from Kantar Worldpanel, the UK grocery market slipped into decline for the first time since January in the 12 weeks ending June 19, 2016. Overall sales at Tesco and Sainsbury’s dropped by 1.3% and 1.4% respectively, while at Asda they were down by 5.9% compared to the previous year. Mid asset swap spreads for Tesco’s 6.125% 02/22 bond widened by 60 bps over the month to close at 370 bps on June 30.