European Credit Update - January 2016

Collapsing commodity prices and soft economic data out of China continued to make headlines in the New Year. Brent crude hit a 13-year low of $27.67 on January 18, amid growing concerns over a supply glut. Meanwhile, data from Fitch showed that European corporate bond issuance fell 70% year on year to €5.9 billion, the lowest January nominal volume in 21 years.

Against this backdrop, central bank policy divergence widened further during the month. The ECB president, Mario Draghi, hinted at more stimulus measures in March, while the Bank of Japan introduced a negative interest rate as part of a three-tier system effective from February 16, 2016. Conversely, the U.S. Federal Reserve kept rates on hold, but said it was “closely monitoring” global economic and financial developments.

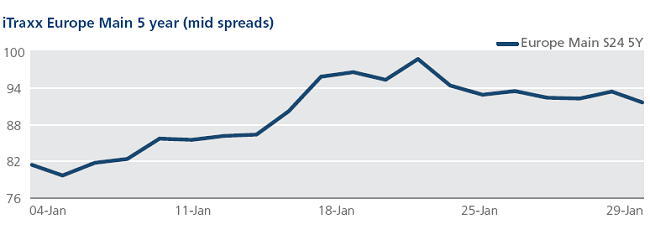

CDS on Tradeweb: Spreads for the Europe (S24) and Crossover (S24) indices hit their month-high levels of 99 bps and 398 bps on January 20; however, both ended the month tighter at 92 bps and 368 bps respectively. Financial indices had a similar trajectory, with spreads for the FinSen (S24) and the FinSub (S24) closing at 92 bps and 207 bps respectively on January 29.

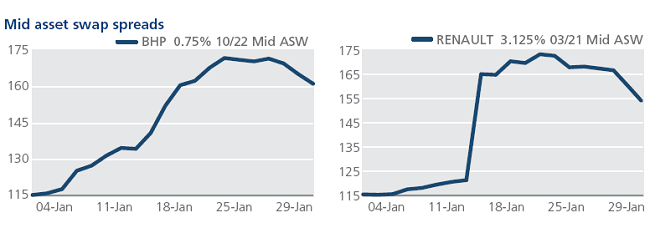

Cash on Tradeweb: On January 15, BHP Billiton revealed an impairment charge of approximately $4.9 billion against the carrying value of its onshore U.S. assets. The Anglo-Australian miner said that the impairment would reduce onshore U.S. net operating assets to approximately $16 billion (excluding deferred tax liabilities of around $4 billion). Mid asset swap spreads for the firm’s 0.75% 10/22 bond widened by 46 bps over the month to close at 161 bps.

Following Volkswagen’s defeat device scandal, French car manufacturer Renault said it would recall 15,000 of its vehicles for emission system checks. The announcement came after police raids on several Renault factories on January 14, as part of an emissions investigation instigated by the French government. In the secondary market, mid asset swap spreads for Renault’s 3.125% 03/21 bond jumped 44 bps to 165 bps on January 14, but finished the month at 154 bps.