European Credit Update - February 2016

Market volatility continued in February amid concerns over sliding oil prices, geopolitical turbulence and macroeconomic conditions. In her testimony before the Senate Banking Committee on February 11, U.S. Federal Reserve chairwoman Janet Yellen said that negative rates were not “off the table” as the central bank was closely monitoring global economic developments.

The euro area re-entered deflation in February, as consumer prices decreased 0.2% year on year following a 0.3% rise in the previous month. Meanwhile, UK Prime Minister David Cameron struck a deal with EU leaders to secure a number of concessions affording his country “special status”. Shortly afterwards, news of the London mayor’s support for the “Leave” campaign raised concerns over the financial repercussions of a potential “Brexit”.

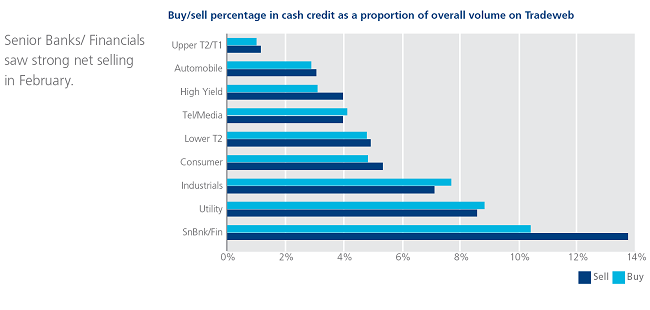

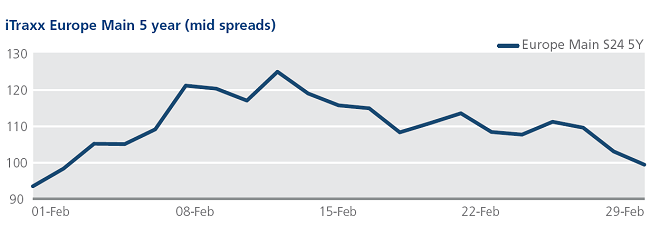

CDS on Tradeweb: Spreads for European credit indices moved wider until February 11, when the Europe and Crossover closed at 125 bps and 484 bps respectively. However, the remainder of February saw both indices retreat to tighter territory, ending the month at 99 bps and 409 bps respectively. Similarly, spreads for financial indices closed the month 29 bps (FinSen) and 87 bps (FinSub) tighter from their respective month-high values of 139 bps and 323 bps on February 11.

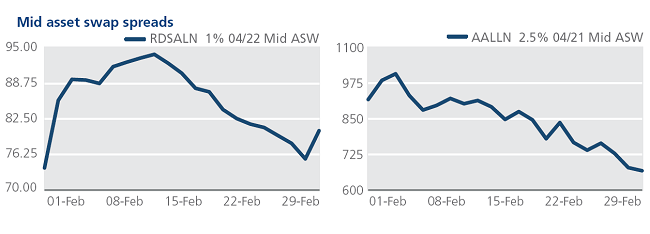

Cash on Tradeweb: Two of Europe’s biggest oil and gas companies reported sharp losses for 2015, as a sustained decline in oil prices took its toll on revenues. On February 2, BP said that its full year profits had dropped to $5.9 billion, down 51% from 2014. Two days later, rival Royal Dutch Shell announced that it had suffered an 80% fall in annual earnings. Shell completed its merger with BG Group on February 15, a move that “will bring a large injection” to its cash flow, according to CEO Ben Van Beurden. Mid asset swap spreads for the Anglo-Dutch firm’s 1% 04/22 bond widened by 15 bps between February 1 and February 4, but ended the month 13 bps tighter than their month-high level of 94 bps on February 11.

In Industrials, mining giant Anglo American suspended its dividend as it posted a full-year pre-tax loss of $5.5 billion on February 16. The UK-listed group plans to sell assets worth $3 billion to $4 billion and focus on its copper, diamonds and platinum businesses. In the secondary market, mid asset swap spreads for the company’s 2.5% 04/21 bond tightened by 250 bps to 667 bps over the month.