European Credit Update - December 2015

In a widely anticipated move, the U.S. Federal Reserve raised the upper bound of its federal funds rate from 0.25% to 0.5% on December 16, the first such increase in nearly a decade. Conversely, the European Central Bank announced an extension of its asset purchasing programme to at least March 2017, and cut its deposit facility rate to -0.3%.

Meanwhile, oil prices continued to slide. Brent crude settled at $37.28 a barrel on December 31, ending the year down by 35%. A day earlier, Saudi Arabia’s oil minister, Ali al-Naimi, had said that the kingdom would not change its production policy; instead, it was ready to meet additional customer demand.

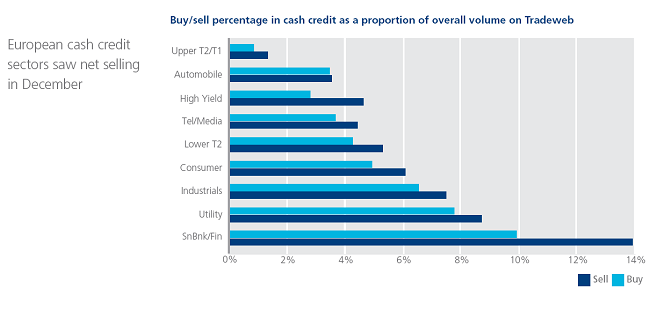

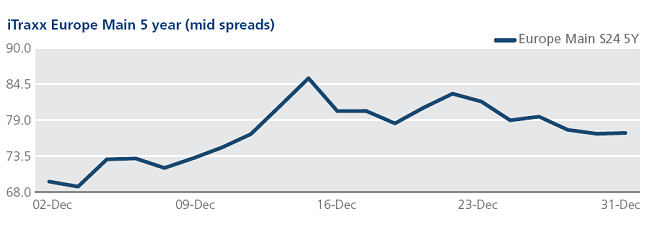

CDS on Tradeweb: European credit indices moved into wider territory during the month, with spreads for the Europe and the Crossover closing at 77 bps and 315 bps respectively on December 31. Similarly, financial indices ended the month 16 bps wider at 77 bps (FinSen) and 158 bps (FinSub).

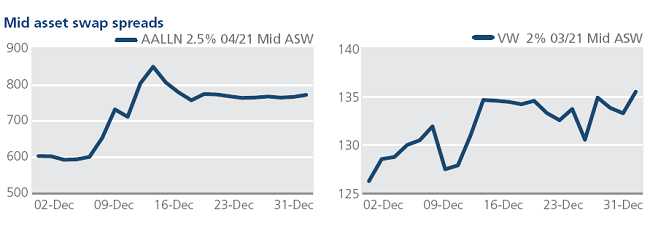

Cash on Tradeweb: Amid the global downturn in commodity prices, Anglo American announced on December 8 that it would reduce its assets by 60%. The London-listed miner also said that it would suspend dividend payments for the remainder of 2015 and in 2016. In the secondary market, mid asset swap spreads for Anglo American’s 2.5% 04/21 bond finished the month 169 bps wider at 773 bps.

According to figures released by the European Automobile Manufacturers Association (ACEA) on December 15, the EU passenger car market grew by 13.7% in November. However, Volkswagen Group saw its EU market share decline by 2.3 percentage points year on year. Furthermore, the EU’s anti-fraud agency, Olaf, launched an investigation into loans Volkswagen received from the European Investment Bank to develop cleaner engines. Mid asset swap spreads for the firm’s 2% 03/21 bond widened by 9 bps over the month to close at 136 bps.