European Credit Update - April 2015

Speculation that Greece could default on its debt increased in April, as negotiations between the country’s new government and its creditors continued. Standard & Poor’s and Moody’s both downgraded Greece’s credit rating, citing concerns over the sustainability of its commitments.

In the UK, the Bank of England’s Monetary Policy Committee announced a unanimous decision to keep interest rates unchanged on April 29, as inflation in March remained at zero – equal with February and the lowest level since similar records began in 1989. Eurozone inflation was flat at 0% in the 12 months to April, up from -0.1% in March.

U.S. total nonfarm payroll employment increased by 126,000 in March, well below economists’ forecasts of 245,000. Gross domestic product also grew more slowly than expected in the first quarter of 2015, at a seasonally adjusted annual rate of 0.2%. The slowdown in growth and hiring was attributed to 'transitory factors' by the U.S. Federal Reserve, which kept interest rates unchanged.

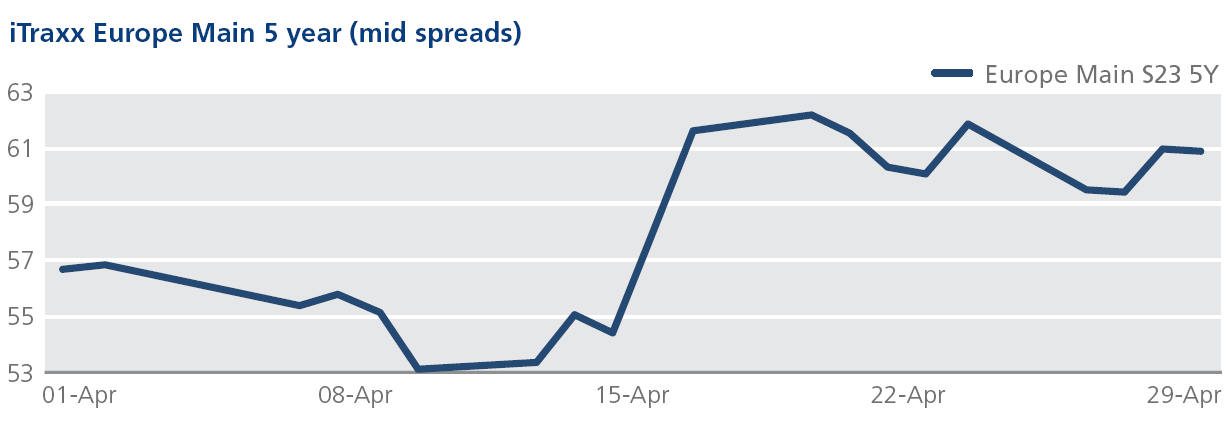

CDS on Tradeweb: April saw a downturn in market volatility in contrast to the previous month. European credit indices rallied in the first two weeks of the month, with spreads for the Europe and Crossover closing at 53 bps and 242 bps respectively on April 10. Both indices, however, ended the month 8 bps and 31 bps wider.

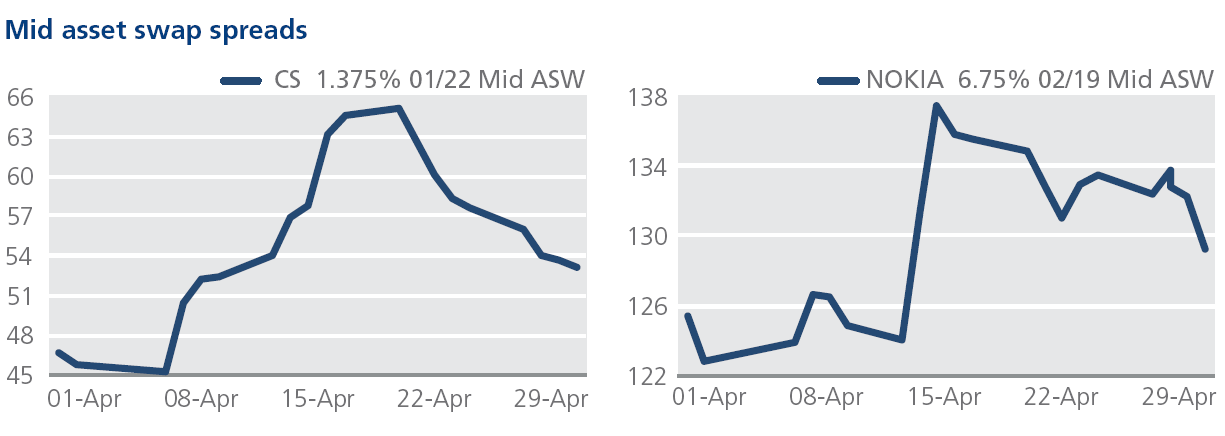

Cash on Tradeweb: As the first-quarter earnings season kicked off, Credit Suisse reported net income of CHF 1.1 billion, up 23% year-on-year. Switzerland’s second-largest lender saw strong performance from its wealth management clients business and consistent strategic returns in investment banking. In the secondary market, mid asset swap spreads for the Credit Suisse 1.375% 1/22 bond tightened from 63 bps on April 21, when the bank announced its Q1 results, to 53 bps at month end.

On April 15, Finland’s Nokia said it had agreed to buy French rival Alcatel Lucent in a €15.6 billion deal. The takeover, which is expected to go through in the first half of 2016, will create a European telecommunications group – Nokia Corporation - with headquarters in Finland and a strong presence in France. Mid asset swap spreads for Nokia’s 6.75% 2/19 bond tightened by 8 bps to 129 bps between mid April and month end.