New Workflow Solutions Drive Block Credit Trades Electronic

Chris Bruner, Head of U.S. Credit at Tradeweb discusses how e-trading is changing the way investors trade as they realize the benefits of an electronic workflow.

While more than 75% of U.S. credit trading still takes place over the phone, block-trading institutional investors are beginning to leverage electronic solutions to streamline the process.

Block credit trading has continued in an analog environment for decades to minimize information leakage by bilaterally negotiating the price or spread of a larger notional block trade–greater than $5 million for high-grade corporate bonds.

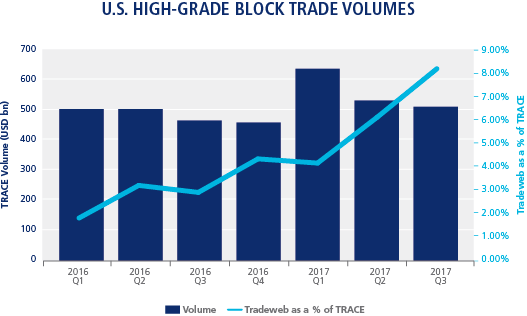

Tradeweb electronically processed 8.22% of high-grade U.S. corporate bond block volume in the third quarter, according to FINRA TRACE data, up over five percentage points from the same period last year. Whereas credit traders historically use e-trading for smaller transactions, block trades now represent more than two-thirds of Tradeweb’s U.S. high-grade volumes, and 23% of its purely electronic volumes.

Benefits Driving Electronic Adoption

Tradeweb has been successful in electronifying traditional voice trades with an automated workflow that links the Treasury spot reference price with the exact level used to offset the interest rate risk.

Far more than electronic trade confirms, this places the power of offsetting the Treasury risk from block credit trades into the buy-side’s hands for the first time, significantly reducing their operational risk and minimizing manual errors, while fostering trading relationships to avoid information leakage.

Investors now trading block corporates on Tradeweb can fully execute, spot, and process their trades downstream in less than 20 seconds. Automated price spotting of Treasuries has brought a new level of trading efficiency to the credit markets and has drastically improved traditional workflows.

To learn more about how Tradeweb can enhance your block credit business, click here.