Data Points: Government Bond Update - July 2014

Key Points:

• Core Bond See Gains

• European Peripheral Economies Rally

• Eastern European Tensions Persist

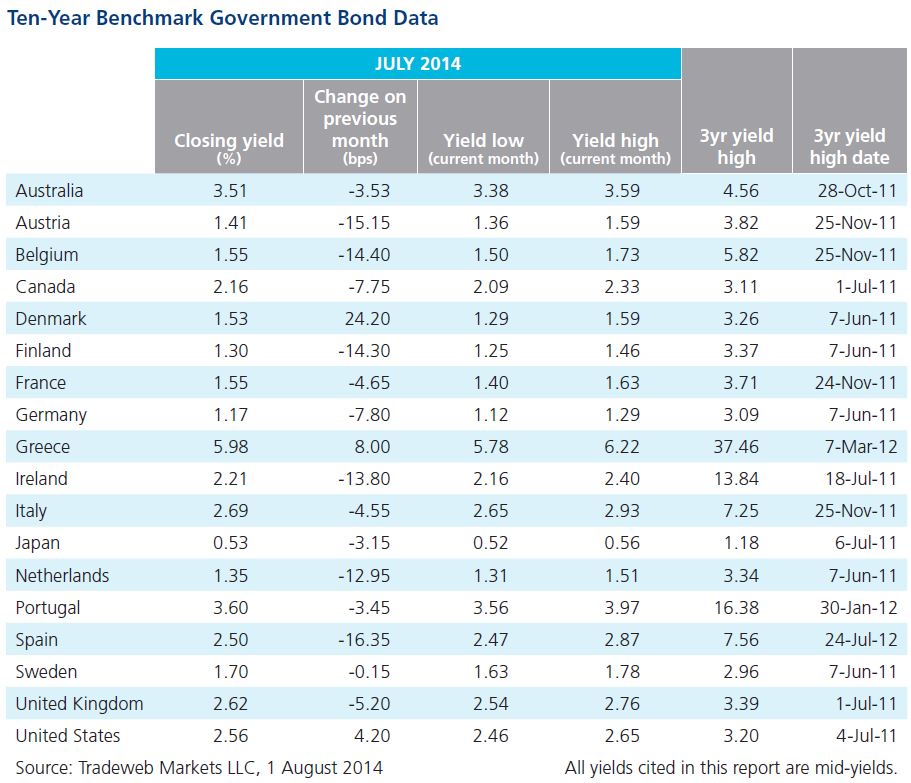

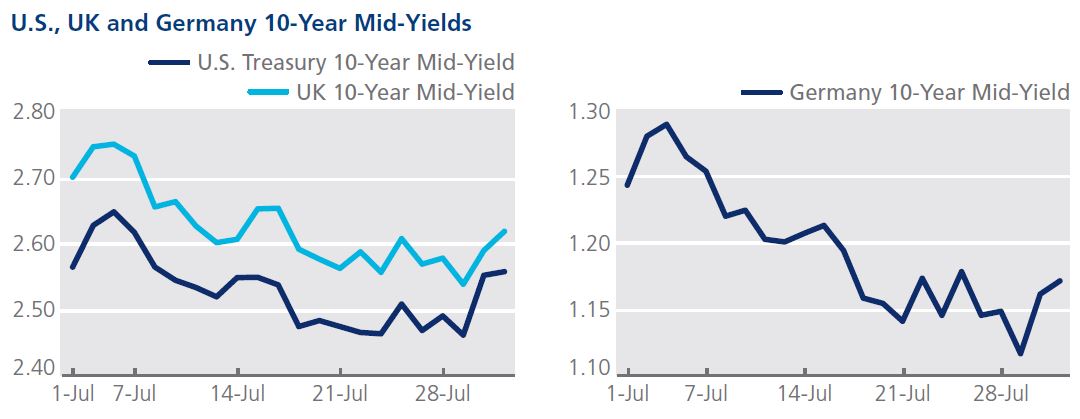

The Federal Reserve announced it would cut bond purchases by $10 billion to $25 billion following strong GDP numbers in July. The better-than-expected second quarter GDP data showed that the U.S. economy grew at a rate of 4%, following a 2.9% contraction in the first quarter. The 10-year Treasury bond note remained fairly stable during the month, with mid-yields starting at 2.56%, rising to a high of 2.65% on July 3 and ending at 2.56%. Mid-yields on U.S. long-term debt also fell, with 30-year bonds opening the month at 3.39% and closing at 3.31% at the end of July. Gilts fluctuated during the month, starting at 2.70%, dropping to a month low of 2.53% on July 29, and rising to 2.62% at month end. Similarly, mid-yields on Germany’s 10-year government bond fell 7 basis points from the beginning of the month to close at 1.17% after reaching a high of 1.26% on July 4.

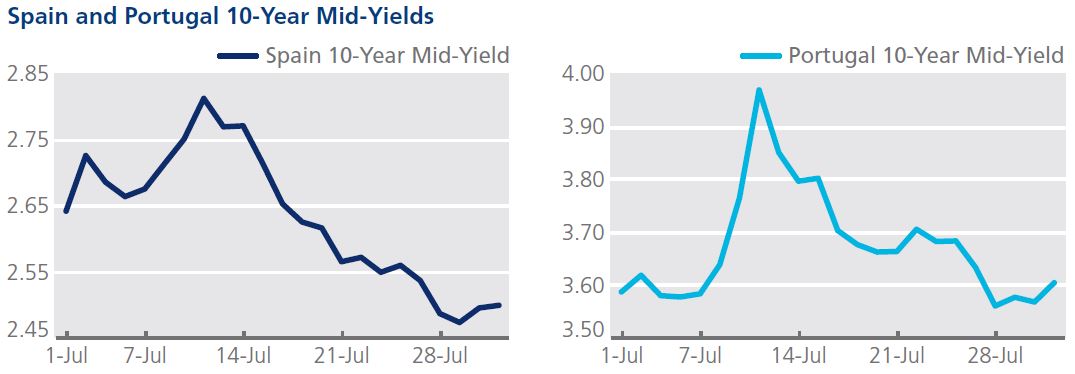

Government bond yields also fell across Europe’s periphery markets in July following the ECB’s resolution to cut interest rates below zero, while introducing a multi-billion euro lending package. The yield on Spain’s 10-year benchmark bond fell below 2.50% on July 28 for the first time in more than two centuries according to Deutsche Bank. Mid-yields on the bond fell 14 basis points from the beginning of the month to close at 2.50%, after hitting a month high of 2.77% on July 14. Portugal’s credit rating was upgraded in July by Moody’s Investors Service to Ba1, one level below investment grade, with a stable outlook. Portuguese 10-year bonds saw some volatility during the month, with mid-yields starting at 3.58%, reaching a month high of 3.97% on July 10, and then falling to 3.60% on July 31.

Meanwhile, Eastern Europe saw geopolitical tensions escalate, resulting in new economic sanctions imposed on Russia. The country’s finance ministry, which holds weekly domestic bond sales, cancelled treasury auctions for two weeks in a row, citing “unfavorable market conditions.” Mid-yields on the Russian USD-denominated sovereign bond maturing in September 2023 rose 55 basis points from the start of the month to close at 4.97%.